Long-Term Riches Development With Real Estate: A Comprehensive Guide

Property has actually long been among the most dependable paths to lasting riches creation. With the right methods, investments in residential or commercial property can generate regular cash flow, tax benefits, and substantial recognition in time. Whether you're a seasoned financier or just beginning, comprehending the fundamentals of structure wealth with real estate is vital to accomplishing economic safety.

In this article, we'll discover how property can be a cornerstone of your wealth-building approach, different investment strategies, and actionable pointers for success.

Why Real Estate is Suitable for Long-Term Wealth Development

Admiration In Time

Property values have a tendency to increase for many years. While markets vary, the long-lasting fad has historically been upward, materializing estate a solid financial investment.

Easy Income Generation

Rental properties provide a consistent revenue stream, which can grow as leas boost with time.

Leverage Opportunities

Financiers can make use of obtained capital to purchase home, raising potential returns compared to the initial investment.

Tax obligation Benefits

Property financial investments come with tax benefits, including depreciation deductions, home loan rate of interest write-offs, and funding gains tax obligation deferments via approaches like 1031 exchanges.

Profile Diversification

Real estate supplies a bush versus rising cost of living and lowers reliance on stock market performance.

Strategies for Long-Term Wealth Creation in Real Estate

1. Buy and Hold Strategy

This involves buying homes and holding them for an prolonged period. Over time, residential or commercial property values appreciate, and rental fees raise, making the most of profits.

Perfect For: Capitalists concentrated on building equity and passive income.

2. Rental Characteristics

Owning rental properties creates regular monthly cash flow while building equity as lessees pay for the home loan.

Tip: Buy high-demand places to guarantee occupancy prices stay high.

3. Fix-and-Hold

Purchase underestimated homes, remodel them, and keep them for long-lasting gratitude and rental revenue.

Suitable For: Investors going to put in initial initiative for potentially greater returns.

4. Realty Investment Company (REITs).

For those who favor a hands-off method, REITs offer a method to invest in property without owning physical building.

Advantage: Provides liquidity and diversity.

5. Multi-Family Properties.

Buying apartment complexes or duplexes can cause multiple revenue streams from a single building.

Advantage: Greater cash flow compared to single-family homes.

Actions to Start Structure Wealth in Realty.

Set Clear Goals.

Specify your objectives, whether it's capital, appreciation, or both.

Comprehend the marketplace.

Research regional market fads, residential or commercial property worths, and rental need to identify rewarding possibilities.

Protected Financing.

Discover options like standard lendings, FHA loans, or partnerships to fund your financial investment.

Pick the Right Residential Or Commercial Property.

Try to find buildings with strong potential for gratitude and rental need.

Concentrate On Capital.

Make certain the property generates positive cash flow after costs like upkeep, tax obligations, and home mortgage settlements.

Expand Your Profile.

Invest in different residential or commercial property types and locations to reduce danger.

Secret Benefits https://sites.google.com/view/real-estate-develop-investment/ of Long-Term Realty Investment.

1. Compounding Returns.

In time, reinvesting rental earnings or gratitude revenues allows for exponential growth in wealth.

2. Equity Structure.

Each home mortgage settlement raises your possession risk in the home, enhancing net worth.

3. Inflation Hedge.

Property worths and leas usually increase with rising https://sites.google.com/view/real-estate-develop-investment/ cost of living, preserving acquiring power.

4. Generational Riches.

Feature can be passed down to heirs, creating a heritage of monetary safety and security.

Tips for Successful Long-Term Property Financial Investment.

Prioritize Location.

Buy locations with strong economic development, great schools, and accessibility to features.

Stay Educated.

Keep up with market fads and guidelines that may influence your financial investments.

Maintain Your Properties.

Routine upkeep makes certain occupant complete satisfaction and maintains home value.

Collaborate with Professionals.

Team up with realty representatives, home managers, and accounting professionals to optimize your financial investment strategy.

https://sites.google.com/view/real-estate-develop-investment/ Hold your horses.

Real estate riches production takes some time. Concentrate on the long-lasting advantages instead of temporary fluctuations.

Leading Areas for Real Estate Financial Investment.

While opportunities exist throughout the united state, certain markets are specifically conducive to long-lasting wide range creation:.

New York City City: High need for rental residential or commercial properties and possible for appreciation.

Upstate New York: Budget friendly entry factors and constant growth in areas like Albany and Saratoga Springs.

Austin, Texas: Thriving technology industry driving housing need.

Phoenix metro, Arizona: Rapid population growth and economical buildings.

Conclusion.

Long-term riches development via real estate is achievable with tactical planning, market understanding, and perseverance. By leveraging the one-of-a-kind benefits of residential or commercial property investment-- appreciation, easy revenue, and tax obligation benefits-- you can build a diversified portfolio that provides monetary safety and generational wide range.

Beginning tiny, enlighten on your own, and take advantage of the many opportunities real estate offers. With the right approach, property can be your ticket to a flourishing future.

Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Anthony Michael Hall Then & Now!

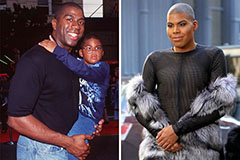

Anthony Michael Hall Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!